Sharing your company’s insights about key industry trends is a powerful B2B PR and content marketing strategy that is effective in fast-evolving sectors like ad tech and martech. By working with your spokespeople to demystify and explain the impact of topical market issues, you can capture media attention, showcase your company’s expertise and position it as a thought leader.

With that in mind, here are six key adtech trends to consider incorporating into your PR and communications efforts. These issues were highlighted at a recent eMarketer Summit I attended.

1) Regulations piling up on digital platforms

eMarketer data suggests that Amazon, Google, Meta, Microsoft and Apple will have doubled their share of digital advertising between 2008 and 2025. However, they’re currently facing five active antitrust lawsuits from the US government. And given their global reach, they’re also subject to antitrust action in other countries, meaning more investigations, lawsuits and fines.

Antitrust pressure on Big Tech is only going to increase, given they’re also among the leading players in the rapidly evolving AI sector.

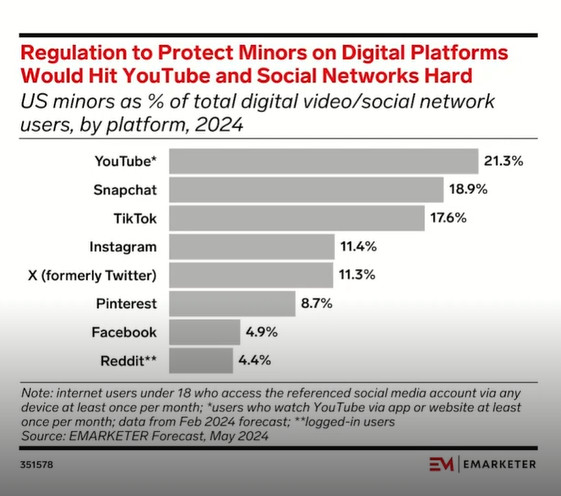

Protecting children online is the other primary current focus of the regulators. The child safety provisions of the UK Online Safety Act are expected to be enforceable from 2025. The EU’s Digital Services Act – which has numerous requirements aimed at protecting minors – came into effect this year.

In the US, Congress is considering two major bills, the Kids Online Safety Act (KOSA) and Children’s Online Privacy Protection Act (COPPA 2.0), which could be passed in 2025. These regulations would pose a challenge for the platforms including YouTube, SnapChat and TikTok (assuming TikTok isn’t banned in the US).

While regulations are typically slow-moving, they could reshape the digital landscape and are sure to fuel lots of media attention and debate for adtech brands to weigh in on.

2) Google feeling the squeeze from retail, social and Gen AI

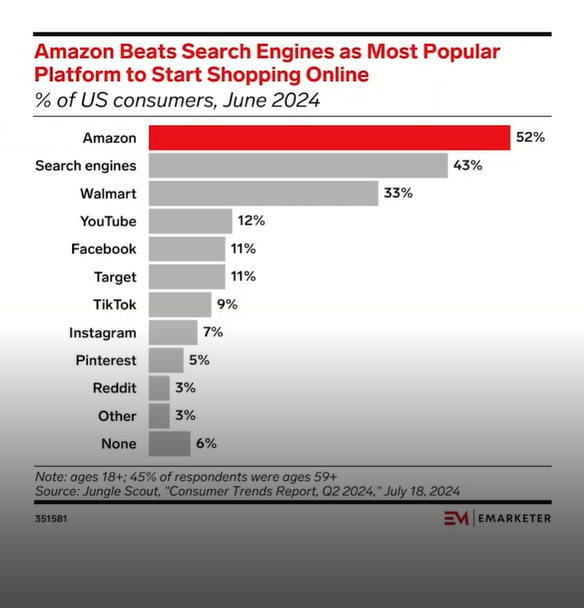

Traditional search players like Google are being squeezed by the number of platforms consumers now use for product research. Retail media is a strong factor in this, with Amazon ahead of traditional search engines as a primary way for consumers to begin product searches. And taken together, social platforms are also a significant competitor to traditional search, with research suggesting two-thirds of US consumers are likely to engage in social search during their product research.

However, it is the retail media segment that’s going to account for the majority of growth in search advertising through to 2028.

Retail media helps advertisers identify and reach high intent consumers (customers who have an intent to buy) with search ads for relevant products – which is spend on search ads is set to account for nearly two thirds of retail media advertising in 2025 (according to eMarketer) .But eMarketer analysts caution that retail media networks must balance monetisation opportunities with maintaining the consumer experience; because shoppers need to be able to find what they are looking for without friction or erosion of trust.

Google is also facing pressure from generative AI-powered search, with new entrants like – Perplexity and ChatGPT Search. However, since they don’t have finalised ad products yet, the debate will likely focus on how AI will trigger changes in search behaviour. Will consumers ask more or different types of questions for example?

For now, eMarketer believes that Google’s status as the default search engine on most major browsers and devices will help protect its dominance (unless the antitrust lawsuit disrupts that default status)

3) Measurement and standardisation impacting retail media’s ‘long tail’

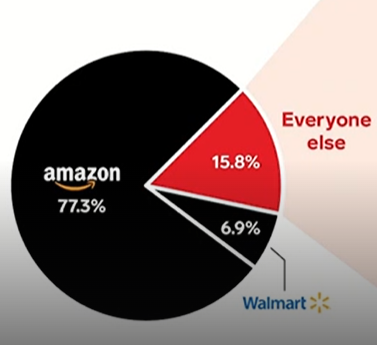

Only around 16% of all ad spend in retail media is not on Amazon or Walmart – and this share hasn’t changed much since 2019. But total ad spend on retail media has grown significantly and so has the number of new of entrants, creating a very crowded and competitive market in this ‘long tail’ of smaller players in the sector.

Spend from advertisers in the long tail is held back by lack of standardisation which make it difficult to manage ads across multiple retail media networks. Different platforms have unique ways of doing business. And comparing campaign performance across them is difficult because there are different definitions with a lack of transparency on how metrics are calculated.

Measurement has been a hot topic in retail media for a while, with the IAB and MRC introducing guidelines in this area. Although the adoption of standards takes time, the smaller retail media networks have the incentive to embrace these to prove their value to advertisers. So there may be progress in this area.

4) Slow growth of instore retail media adertising

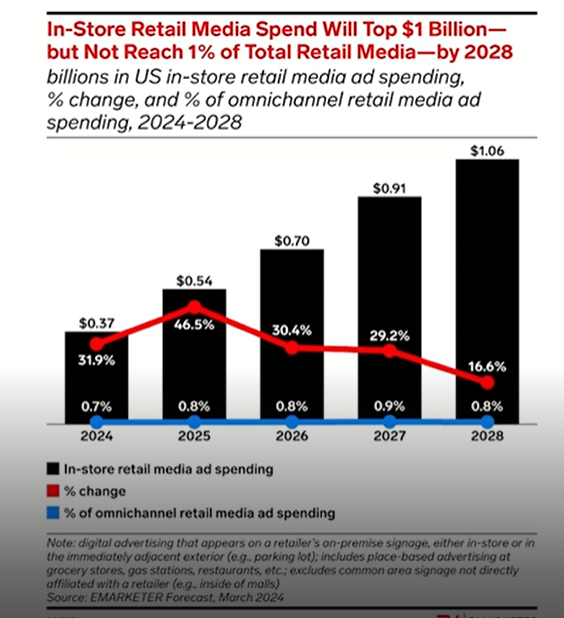

When you think that brick-and-mortar retail accounts for around 83% of all retail sales in the US, ad spend on digital media within physical stores is surprisingly small by comparison. While it is expected to exceed $1 billion by 2028, it will still make up less than 1% of total retail media spend.

The most frequently cited barrier is the high capital investment required by retailers—mainly on the hardware and tech needed to show digital ads to shoppers in stores. Measuring the impact of in-store digital media is also complex. It’s more like out-of-home advertising than placing digital ads on retailer websites. The diversity of ad formats adds to measurement and tracking challenges – from smart shopping carts and ‘scan and shop’ mobile apps (which can show ads based on what shoppers are scanning or their location in a store) to in-store audio.

According to eMarketer, advertisers will likely begin by trialing in-store digital media ads by reallocating the budget from static ads in stores rather than adding a new budget to this area. There’s also potential for growth from out-of-home advertisers (who don’t sell products in-store) treating it as an additional out-of-home placement.

5) Streaming media’s customer churn problem

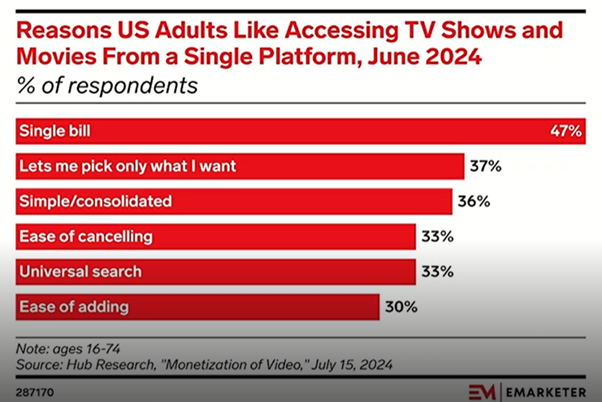

Streaming media platforms continue to struggle with customer churn. The output of scripted content declined because of COVID and again in 2023 due to the Hollywood writers’ strike, and it hasn’t fully recovered. This reduction in new content means that, over time, subscribers see less need to keep paying for multiple subscriptions. They also want to streamline their subscriptions into a single monthly bill that’s easier to manage.

Of all the streamers, Netflix remains the most “sticky,” with more than half of its customers maintaining their subscriptions for over six months. As churn rates have increased, many platforms have introduced ad-supported tiers to reduce prices. Bundling is also becoming a popular way to consolidate services into one bill: Amazon Prime has long bundled Prime Video and it now also partners with Apple TV+ to feature its content. Walmart+ is offering a Paramount+ bundle as well.

However, bundles often fail to increase viewers, as many people are unaware that they can access additional platforms through these packages. To further combat churn, streamers are producing more unscripted content like game shows and reality shows, which are cheaper to make than scripted programming. But it’s unclear if these types of shows will resonate with consumers enough to keep them paying for subscriptions.

6 Creators taking over in social video

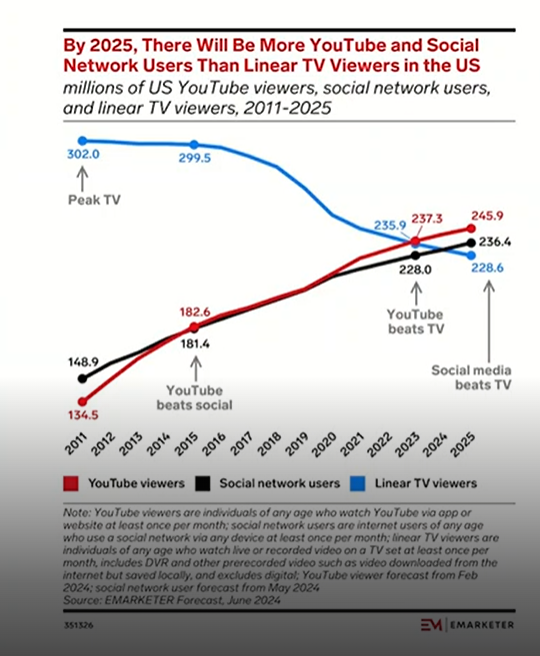

We’re nearing a tipping point where social network users and YouTube viewers will soon outnumber linear TV viewers. While time spent on linear TV is declining, it’s increasing on social platforms. The increase in available video ad inventory on social will drive more ad spend in this area.

A major factor in social video growth is the success of social media creators who’re producing vast amounts of video, including episodic series that keep users engaged and even encourage binge-watching.

According to eMarketer, advertisers are likely to diversify their video strategies by partnering with creators who also have a big influence on purchases. For instance, consumers who make purchases based on social media influence are more often swayed by creators than by content from brands, retailers, or even peers.

As an adtech or martech vendor, your PR and comms can’t always be focused on content that promotes your products and services. You can build awareness and trust by discussing the key issues that are shaping the industry. Identify the hot topics that your customers and other stakeholders care about and use them to fuel

your PR and content plans – from guest comment articles, editorial interviews and newsjacking pitches, to company blogs, social media posts and in-depth white papers.

Image by Mirko Grisendi from Pixabay